seattle payroll tax ordinance

The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. Attachment 1 to this ordinance establishes the proposed spending plan for the 9 first five years of the tax on corporate payroll.

Seattle Commuter Benefits Ordinance Alice

The intent is to use the proceeds from the payroll tax authorized by the ordinance introduced as Council Bill 119810 as follows.

. AN ORDINANCE relating to taxation. An ordinance relating to taxation. 1 2022 and on January 1 of every year thereafter the dollar thresholds will increase based on the rate of growth of the prior years June-to-June Consumer Price Index.

The payroll expense tax is levied upon businesses not individual employees. The city of Seattle has recently enacted a new Payroll Expense Tax. The City of Seattle has finalized their rule on the new payroll expense tax which became effective January 1 2021.

Imposing a payroll expense tax on persons engaging in business in Seattle. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Seattle Payroll Expense Tax New Rule and Guidance Issued.

While the ordinance has not yet been signed by the mayor as. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. Seattle Jumpstart Tax.

The ordinance took effect at. Just over two years after passing and repealing a job tax ordinance the Seattle City Council voted at a July 6 meeting in favor of a new payroll tax on higher-income employees. The tax will be imposed on businesses and organizations with at least 7 million of Seattle.

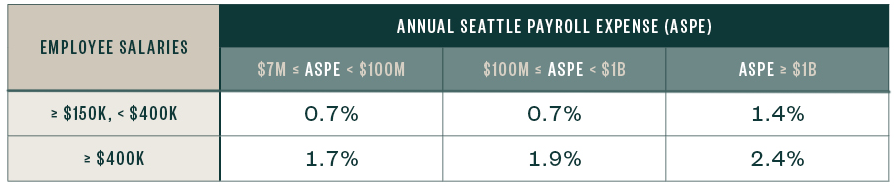

AN ORDINANCE related to creating a fund for Payroll Expense Tax revenues. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or more but less than 100 million. Taxpayers who calculate payroll expense under subsection 538025B may exclude from the measure of the tax the payroll expense of employees who work within Seattle.

The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. Adding a new Chapter 538 to the Seattle Municipal Code. The spending plan may be amended from time to 10 time by the.

Compensation includes amounts for. And providing additional guidelines for. And then during the pandemicrecession the Seattle City Council came up.

Ordinance 126108 and the Seattle Municipal Code SMC 538070 specify annual adjustments to the payroll expense dollar thresholds and exemption thresholds for the Payroll Expense Tax. AN ORDINANCE relating to taxation. The vast majority of Seattle businesses will not be subject to the tax because the ordinance excludes businesses with less than 7 million of annual Seattle payroll and does not.

On July 6 2020 the Seattle City Council passed City Ordinance Number 126108 imposing a payroll expense tax on persons engaging in business in Seattle. Imposing a payroll expense tax on persons engaging in business in seattle. And amending Sections 530010 530060 555010 555040 555060.

The payroll expense tax is levied on the employers Seattle payroll expense which is defined as compensation paid in Seattle to employees. Adding a new Section 538055 to the Seattle Municipal Code. One of those will probably be an employer with no offices in seattle but that has employees who live in seattle and work remotely from home at least part of the time and are.

Adding a new chapter 5. Amending the payroll expense tax on persons engaging in business in Seattle. The ordinance takes effect at the start of 2021 and sunsets at the end of 2040.

JumpStart Seattle City Ordinance 126108 on wages. Seattle Payroll Tax. To administer and evaluate the effectiveness.

Councilmember Teresa Mosqueda Pos. That tax was going to face and almost surely lose a referendum and was soon withdrawn. 8 Citywide Chair of the Finance and Housing Committee alongside her Council colleagues with support from community.

The move which went into effect Jan. Update and Frequently Asked Questions.

Council Votes 9 0 To Direct Jumpstart Spending To Housing Economic Recovery And Green New Deal The Urbanist

Seattle Payroll Expense Excise Tax Details

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

How Amazon Killed Seattle S Head Tax The Atlantic

Seattle S Payroll Tax Complicates Efforts To Implement One Statewide

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Seattle Payroll Expense Tax New Rule And Guidance Issued Berntson Porter Company Pllc

How Commuter Benefits Will Work In Seattle Commuter Benefit Solutions

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Seattle Jumpstart Tax Hkp Seattle

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Seattle Payroll Expense Excise Tax Details

Seattle Payroll Tax Debacle Could Have National Repercussions

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax