life insurance policy for parents

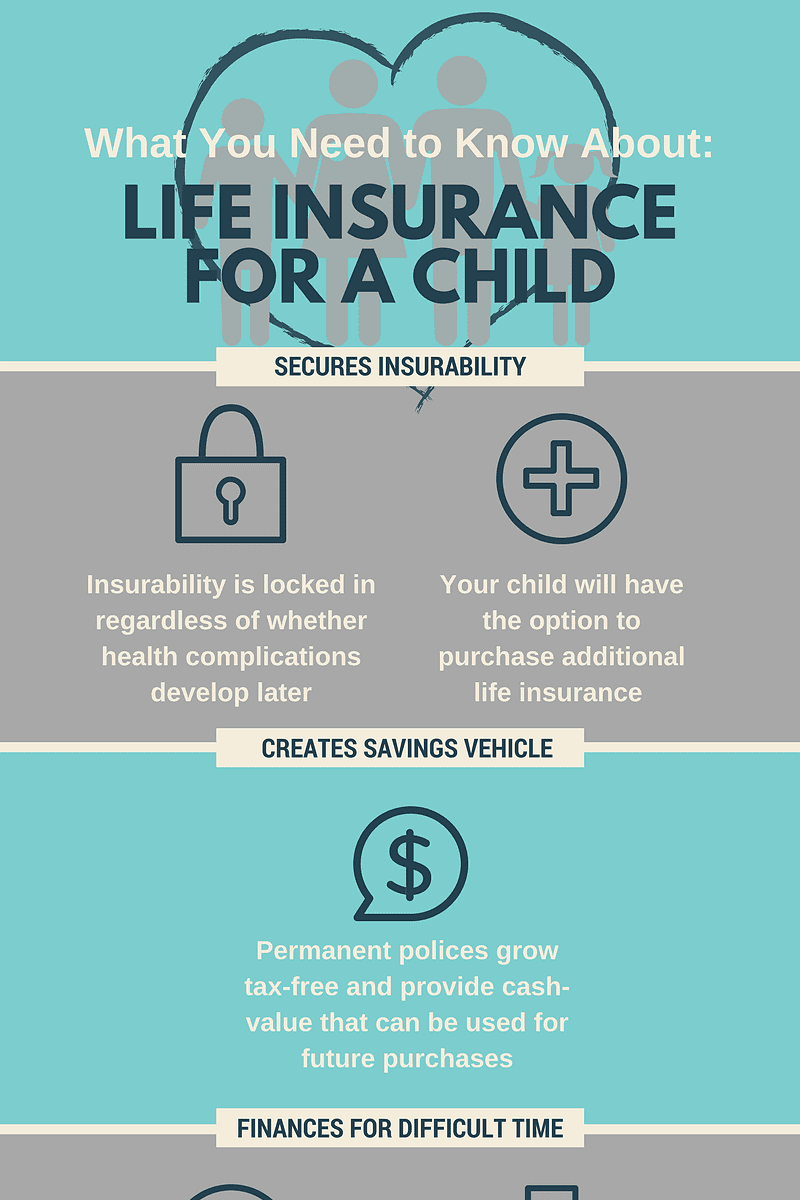

There are many different types of life insurance policies each catering to different situations and supplying different benefits. In this article we explain the life insurance policies that parents buy for their children the logistics of transferring the policy from parent to child and what you can do if.

Life Insurance Policy For Parents Top 5 Considerations Life Insurance Policy Life Insurance Quotes Life Insurance Cost

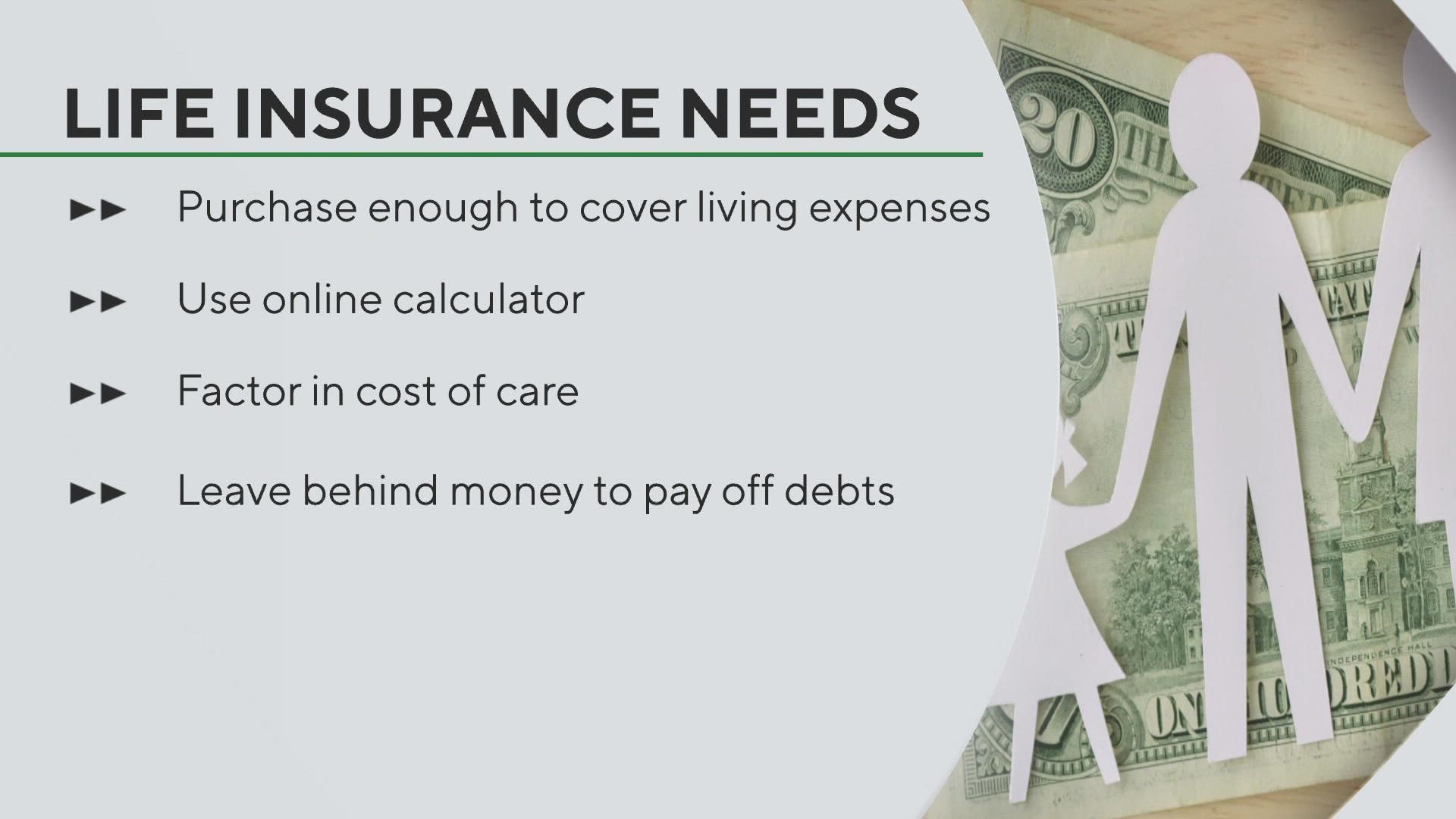

Use the following formula to determine how much life insurance your parents may need.

. Up to 15m cover depending on your age 78. The most common types of life insurance policies children buy for their parents include the following. Life cover or Life Insurance covers death or Terminal Illness to help protect your familys future.

Children age 15 or older must. For example you may buy a 250000 term life. Generally life insurance costs more for fathers than mothers.

However it can be. In addition they only cover the insured for a set period. What type of life insurance should your parents have.

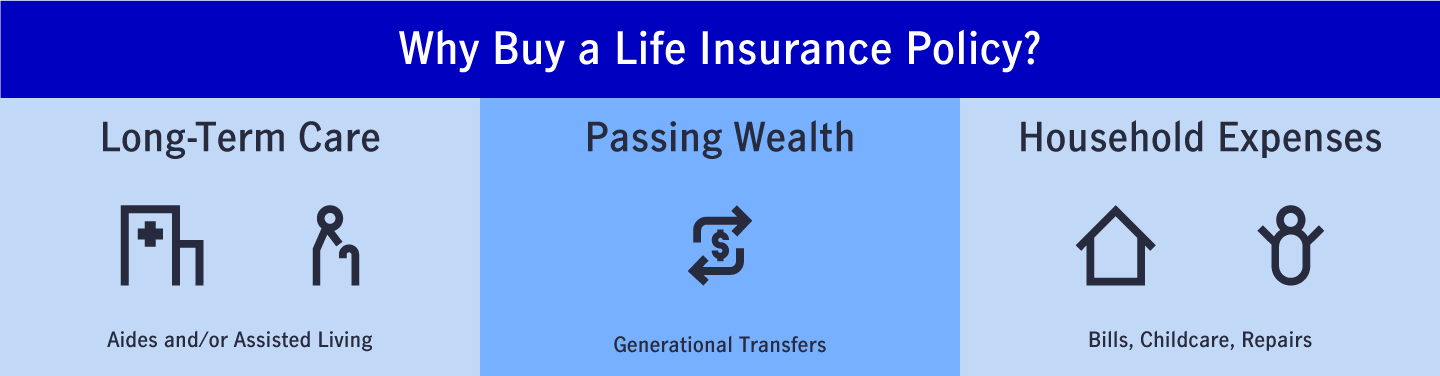

This is because fathers have a shorter life expectancy than mothers according to statistics from the Center for Disease. With term coverage you cannot cover hospital bills or funeral expenses and leave wealth for. If faced with any of these emergencies it can cost you thousands and sometimes lakhs of rupees.

Mortgage Other debts Burial costs Financial needs for beneficiaries Liquid. Buying Life Insurance For Your Parents Requirements. On the other hand this might not be the best choice if you or your parents are in their 60s and 70s.

Term life insurance is the best choice if a parents death would lead to a substantial financial loss loss of household. So if youre looking for the best life insurance policy for parents you may want to buy a small permanent plan that will cover these funeral costs. This policy can be used to cover things like final expenses medical bills or even estate taxes.

Term life insurance pays a death payout but has no monetary value. Guaranteed Acceptance Life insurance to provide a limited amount of coverage. 8 hours ago On average life insurance for a parent will cost 50-250 monthly for 10000-50000 in coverage.

Factors to Consider While Purchasing Life Insurance for Parents Check for the maximum renewal age ie the age till when the policy gets renewed for the life insurance plans. Income Debt Mortgage Other expenses ie. Term life insurance is often the best life insurance for young parents.

Which Policy for Parent Life Insurance Is Best. Terminal Illness where death is likely to. This type of policy covers a specified term such as 10 or 20 years for a specified coverage amount.

Senior citizen travel insurance will also get you 24X7 emergency assistance and help. If the premium has. Yes you can buy life insurance for your parents or any other consenting adult.

For approximately 75 per. 415 55 votes In most cases only birth or adoptive parents or court-appointed legal guardians can take out life insurance on children under age 17. If your parent was still paying premiums on their life insurance policy you may be able to find records of checks or electronic payments in their recent bank statements.

Deciding on an amount of life insurance to purchase for your parent requires you to consider some important factors. We collected over 5000 data points from 91 life insurance companies to measure fiVery affordable term insurance premiumsTerm lengths of up to 40 yearsGood selection of policy types See more.

Life Insurance For Parents Get Them Covered Insurance Geek

Solved Your Parents Took Out A Life Insurance Policy On You Chegg Com

Buying Life Insurance For Your Parents Requirements Cost

10 Mistakes When Buying Life Insurance For Your Parents Glg America

Family Life Insurance Life Insurance For Parents And Children Quotacy

Which One Is Better For Parents Individual Or Family Floater Health Insurance Plan

Buying Life Insurance For Your Parents Requirements Cost

Buying Life Insurance For Someone Else John Hancock

Life Insurance For A Stay At Home Mom Bestow

Six Types Of People Who Need Life Insurance Starkweather Shepley Insurance Brokerage

The High Cost Of Renewing A Term Life Insurance Policy Forbes Advisor

Life Insurance Calculator How Much Do I Need Moneyunder30

:max_bytes(150000):strip_icc()/New_York_Life-fe244fbe4c0b4c3a842fa2c15f06f2c7.jpg)

Best Life Insurance For Parents Of 2022

What Should I Do With The Whole Life Insurance Policy My Parents Bought When I Was A Kid Yqa 131 2 Youtube

What You Need To Know About Children S Life Insurance Infographic

Should I Buy Life Insurance For My Parents Forbes Advisor

Can You Buy Life Insurance For Your Parents